Favorable Phrases and Prices: SBA loans typically give for a longer time repayment phrases and decreased fascination costs than conventional loans, earning every month payments additional manageable for new business homeowners.

There’s a downside to phrase loans, nonetheless. Your desire price gained’t be practically as little as It will be with an SBA loan. Lenders tackle far more danger when letting businesses borrow money on their own, rather than doing this with the SBA guaranteeing the vast majority of loan’s price in the event that a business can’t pay back.

Features up to 25% in extra financing to cover smooth expenses, such as installation, taxes and freight.

Discover much more refinance and home equityToday's refinance ratesBest refinance lenders30-12 months fastened refinance rates15-yr fixed refinance ratesBest cash-out refinance lendersBest HELOC Lenders

Determine what your great repayment conditions is likely to be. The repayment phrase influences both your month to month payment volume and the entire desire you pay. A shorter repayment phrase may perhaps conserve you dollars, even so the regular monthly payment shouldn’t be more than your price range will allow.

Conversely, if the business usually takes on payments for equipment that doesn’t crank out income, that supplemental expense can hurt dollars circulation. Equipment usually depreciates, and will be difficult to sell when it’s now not desired.

Equipment financing might be a terrific selection for businesses that need to have to create a giant order in the form of equipment, equipment or maybe technology (e.

Commonly the reduce The share, the higher. Nevertheless, it's best to have a look at an organization's P/S ratio compared to the P/S ratios of comparable firms in a similar market.

Responses have not been reviewed, approved or otherwise endorsed because of the charge card, financing and repair firms and It isn't their obligation to ensure all posts and/or questions are answered.

Startups will usually Possess a more challenging time qualifying for equipment financing, but you'll find exceptions. A business proprietor with several years of knowledge in an business could possibly qualify for equipment financing even if the business how to get a loan for my small business is completely new. An illustration would be a physician opening her own apply.

Applying for an SBA loan to finance a laundromat involves an in depth course of action to be certain each the viability of the business and also the borrower's capability to repay the loan. Here is a step-by-move manual that may help you navigate the process:

These equipment financing corporations can provide gurus who will be experienced about the particular style of equipment you want to acquire for your business, something which will not be out there at a financial institution or on the net lender.

*Notice: Enter a loan amount of money that fulfills your credit score have to have on your specific scenario. Insert A selection of fascination premiums to demonstrate the effect on the payment or loan volume.adatext

A business equipment loan isn’t for everyone. You might require a substantial deposit and good credit to qualify. Financing business equipment is, certainly, dearer than paying for it with income.

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Tyra Banks Then & Now!

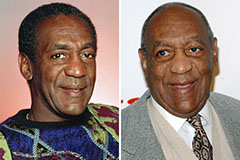

Tyra Banks Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!